International Economy

The latest OECD Economic Outlook notes that the global economy continues to confront persistent inflationary pressures with the headline inflation rate across the OECD expected to be 3.8 per cent in 2025. Global GDP growth has been stronger than expected in 2023, however, growth is expected to moderate in the face of tighter financial conditions, weak trade growth and lower business and consumer confidence. Global GDP is expected to grow by 2.9 per cent in 2023, moderating to 2.7 per cent in 2024 before recovering to 3 per cent in 2025 as official interest rates are lowered.

While seeing global growth picking up over the medium term, the OECD still sees risks tilted to the downside. This centres around the potential for current conflicts to widen resulting in more disruptions to energy markets and international trade. Such disruptions run the risk of adding to inflation which would lead to interest rates remaining higher for an extended period of time. Currently the OECD sees interest rates remaining at current levels well into 2024.

The OECD forecast that Australia’s economic growth will slow from 1.9 per cent in 2023 to 1.4 per cent in 2024, before recovering to 2.1 per cent in 2025. Higher interest rates and cost of living pressures are projected to dampen household spending, particularly in households that do not have accumulated savings.

While central banks and the OECD are currently maintaining the “higher for longer” mantra for official interest rates, money markets in the US and Europe and now pricing in cuts to interest rates as inflation slows more quickly than anticipated. The markets are expecting the US Fed Reserve to cut interest rates in May 2024, with some pricing in cuts as early as March. Similarly, markets now expect the European Central Bank to cut interest rates as soon as April.

Australian Economy

The RBA Board decided to leave the cash rate at 4.35 per cent at its meeting on 5 December. This move is in line with market expectations and reflects the fact that there had been limited additional information for the Board to assess since its November meeting where it increased rates by 25 basis points. The main issue going forward will be the assessment of how quickly the inflation rate will return to the 2-3 per cent target range. The RBA has signaled that inflation has been more persistent than originally expected and is taking longer than expected to moderate to acceptable levels. Australia appears to behind to curve compared to the US and Eurozone where inflation appears to be moderating more quickly and focus turning to when interest rates may start to decline.

The RBA Board statement noted “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.” Key amongst this will be the December quarter CPI release in late January just prior to the next RBA Board meeting and what happens in the labour market.

While being less influential than the quarterly CPI, the monthly CPI for October showed an increase of 4.9 per cent over the previous 12 months which would have played into the RBA decision to hold interest rates steady this month. The October result was a reduction compared with 5.6 per cent in the year to September at the peak of 8.4 per cent in December 2022.

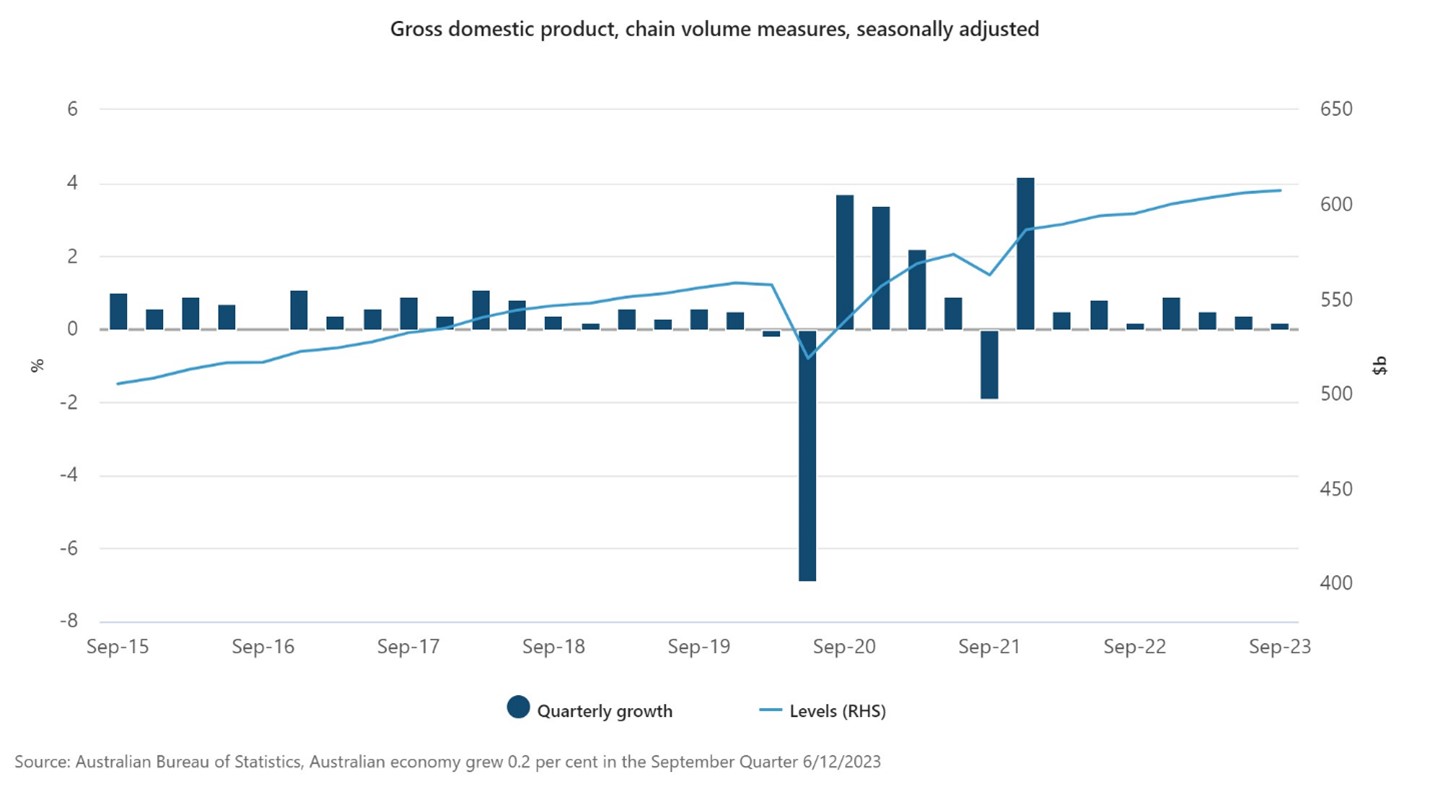

The latest national accounts show the economy grew by 0.2 per cent (sa) in the quarter. This is well below market expectations of 0.4 per cent. Over the year to September GDP rose by 2.1 per cent. Per capita GDP fell by 0.3 per cent over the year to September and by 0.5 per cent in the September quarter – population growth continues to outpace output. The slower than expected growth along with weaking consumer spending confirm the ramp up in interest rates since May 2022 is impacting the economy, albeit having taken longer than expected.

The terms of trade fell 2.6 per cent as export prices fell (-1.4 per cent) and import prices rose (+1.2 per cent) rose. Export prices for coal and LNG declined with elevated levels of inventories in export markets curbing demand. Strong oil prices and the depreciation of the Australian dollar led to rises in import prices during the quarter.

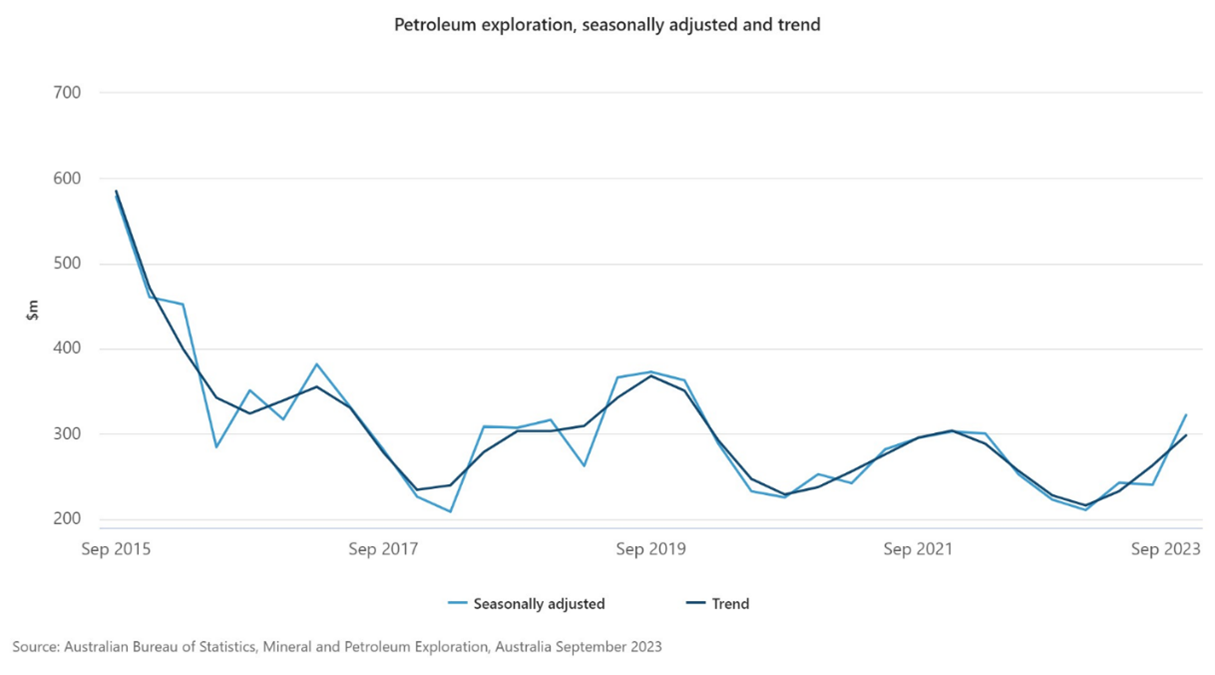

The ABS September quarter Minerals and Petroleum expenditure recorded a rise in petroleum exploration expenditure of 34.2 per cent or $82.0 million to $321.9 million in seasonally adjusted terms. Onshore exploration expenditure rose by 13. 7 per cent ($21.2 million) to $175.8 million while offshore expenditure rose by 71.3 per cent ($60.8 million) to $146.1 million. While the expenditure for the quarter was up, over the longer term, exploration expenditure has declined significantly.

If you would like more information or have any questions please feel free to reach out to me.

Wayne Calder

Director Economics

0424 852 384

[email protected]