Australian Economy

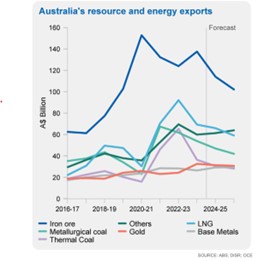

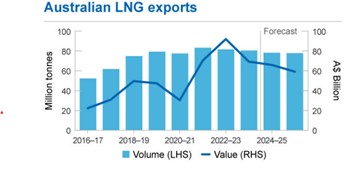

The Resources and Energy Quarterly (REQ) June 2024 is forecasting Australia’s resources and energy exports to fall to $417 billion in 2023-24 from $466 billion in 2022-23 with further falls to $380 billion in 2024-25 reflecting declining commodity prices and a peak in the AUD/USD exchange rate. LNG export revenues are forecast to decline from $69 billion in 2023–24 (down from $92 billion in 2022-23) to $59 billion by 2025–26 with volumes steady but lower LNG prices as global supply ramps up. Exports from the US and Qatar are expected to increase to 150 mtpa and 142 mtpa by 2030 respectively.

The REQ indicates that Artificial Intelligence could be an upside for LNG demand and prices. An AI search requires far more energy than a Google search, and a large scale-up of AI technology and data centres would boost global energy use. The flexibility of LNG makes it an effective means to manage energy peaks in the short-term although the REQ notes that further development of CCS would be needed to prevent a rise in carbon emissions.

The minutes to the recent RBA Board meeting confirm that the RBA considered raising interest rates or keeping them on hold. There was no discussion on lowering interest rates. The weakening of the labour market and the desire to maintain the gains in employment were key to the decision to hold interest rates steady. However, the Board did note the upside risks to inflation requires vigilance going forward.

International Economy

In the US the core personal consumption expenditures price index increased 0.1 per cent in May and was up 2.6 per cent over the twelve months to May. This marked the lowest annual rate since March 2021. Market expectations are pricing two interest rates cuts for 2024 (down from six at the beginning of the year) starting in September.

The US unemployment rate rose to 4.1 per cent in June, the highest level since October 2021. The forecast had been for the jobless rate to hold steady at 4 per cent. The increase in the unemployment rate came as the labor force participation rate, which indicates the level of working-age people who are employed or actively searching for a job, rose to 62.6 per cent, up 0.1 percentage point. The latest jobs report revised down the number of jobs created in April and May by 111,000. Taken together with the rise in the unemployment rate suggests the US labour market is showing signs that it is weakening.

In testimony before the US Senate, the Fed Reserve Chair noted concern that leaving interest rates to high for too long risks damaging economic growth. The Chair specifically noted the slowing of the labour market as a risk that sits alongside managing inflation back to the target. This is similar to the line of the RBA Governor in maintaining the gains in employment in the Australian economy while reducing the inflation rate.

The inflation rate in the European Union fell to 2.5 per cent in June, down from 2.6 per cent in May. Both core inflation and services inflation remained steady at 2.9 per cent and 4.1 per cent respectively. The European Central Bank (ECB) cut interest rates by 0.25 per cent earlier this month. Markets are anticipating 2 further cuts to interests rate by the ECB this year.

The Chinese economy remains subdued with the CPI rising by 0.2 per cent in the twelve months to June. However, the CPI fell by 0.2 per cent in June compared with May. The downturn in the property sector and fears of job insecurity have dampened consumer sentiment and industrial activity has been weak. Some analysts have raised the prospect of deflation emerging in China.

Wayne Calder

Director Economics

0424 852 384

[email protected]