Australian Economy

The latest ABS labour force survey has recorded a small uptick in unemployment of 0.1 per cent to 4.1 per cent (sa) in June with 608,200 people unemployed. This rise in the unemployment rate came despite employment rising by 50,200. Total employment stands at 14,406,100. The participation rate remains at a near record high of 66.9 per cent. Full-time employment increased by 43,300 and part-time by 6,800.

The ongoing strength of the labour market has again raised concerns about the RBA increasing interest rates at its next meeting in August. The RBA has previously stated that it expects the unemployment rate to rise to 4.5 per cent as the economy deflates and inflation returns to the target range. The next key piece of data will be the June quarter CPI release at the end on the month.

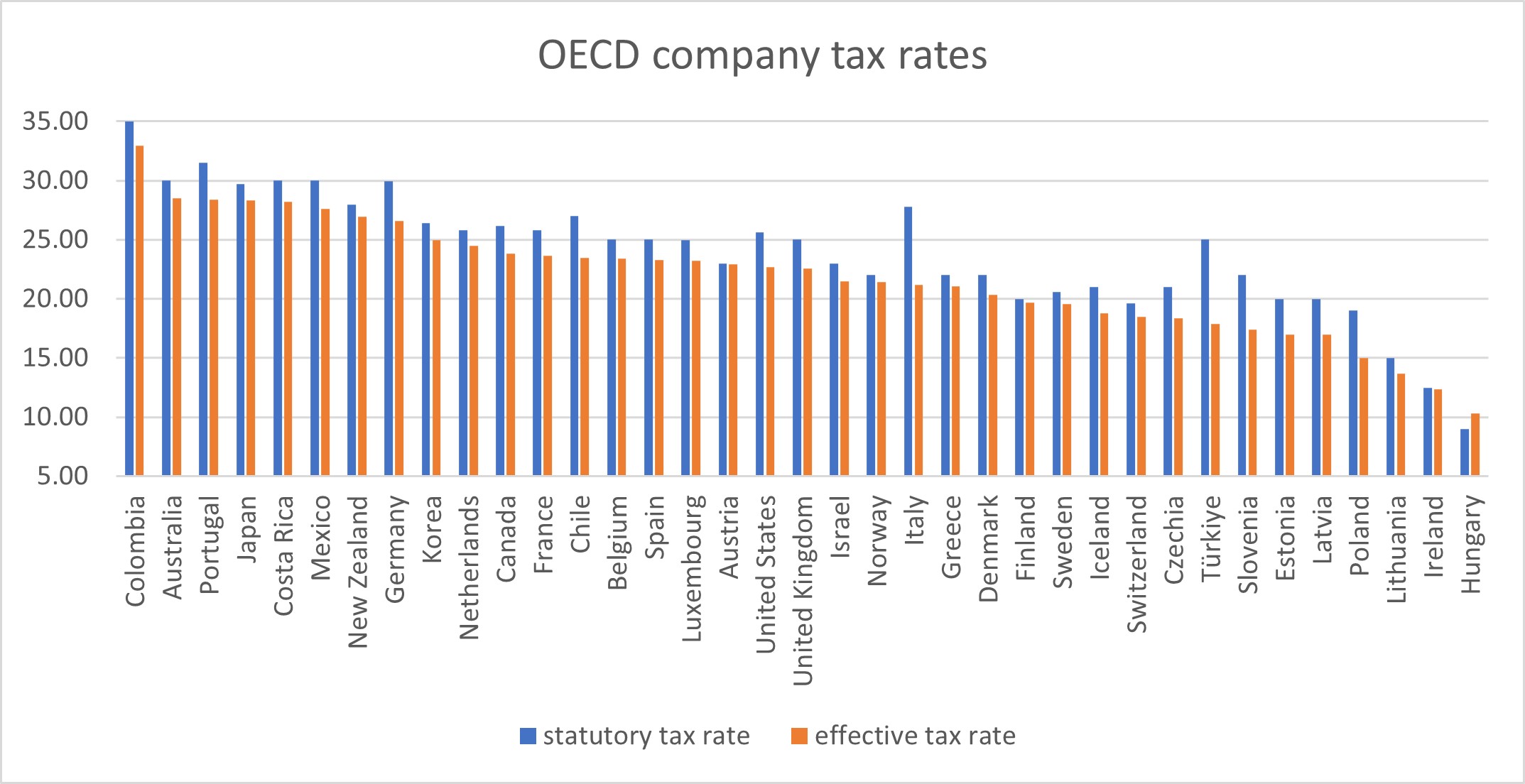

The latest OECD report of Corporate Tax Statistics shows Australia has among the highest company tax rates across OECD economies. The average statutory tax rate across the OECD was just under 24 per cent with the average effective rate being 21.8 per cent. This compares with Australia with the statutory rate of 30 per cent and an effective tax rate of 28.5 per cent. Company taxation account for more than 22 per cent of total tax revenues in Australia, compared with 16.0 per cent globally. The reliance on company taxes and personal income tax (52 per cent of the tax take) in Australia has the potential to reduce investment and productivity growth in the economy. It also signals future budgetary problems with the aging population leading to a higher dependency rate with fewer taxpayers supporting a greater proportion of non-working population.

OECD (2024), Corporate Tax Statistics 2024, OECD Publishing, Paris, https://doi.org/10.1787/9c27d6e8-en.

International Economy

The latest World Economic Outlook update by the International Monetary Fund (IMF) forecasts global growth of 3.2 per cent in 2024 and 3.3 per cent in 2025. For Advanced Economies growth is forecast at 1.7 per cent in 2024 and 1.8 per cent in 2025 while Emerging Market and Developing Economies are expected to growth by 4.3 per cent across both 2024 and 2025.

The IMF is projecting US growth to be 2.6 per cent in 2024 a slight downward revision from the April forecast and Japan is expected to grow by 0.2 per cent. China is forecast to grow by 5 per cent in 2024 but is expected to see a deceleration in growth to 3.3 per cent by 2029 due to the aging of the population and slowing productivity growth. The IMF is also projecting energy commodity prices to fall by 4.6 per cent in 2024 despite ongoing oil production reductions by OPEC and Middle East conflict.

The risk to the outlook is the persistence of inflation in services prices leading to a slowing of disinflation and interest rates being held higher for longer. A ratcheting up trade and geopolitical tensions could also raise price pressures could also feed into global inflation and impact on the normalization of monetary policy. Higher interest rates will also raise borrowing costs for governments at a time where significant levels of debt are still outstanding from the pandemic response and elections in many countries driving further spending commitments.

The US Consumer Price Index dropped 0.1 per cent in June with the annualised inflation rate falling to 3 per cent from 3.3 per cent in May. Markets had expected a rise of 0.1 per cent in the June monthly data and 3.1 per cent for the annual rate. The core CPI rose 0.1 per cent — its slowest pace since August 2021 — with the annual rate of core inflation falling 0.1 per cent to 3.3 per cent.

The Chinese residential property sector continues to be a drag on the economy with falling prices leading to declining perceptions of wealth and impacting consumer spending. Typically, China would rely of boosting exports to counter weakness in the domestic economy. However, there are rising trade tensions with the US and Europe with the threat of increased tariffs on Chinese exports. The latest data on economic growth indicate that China’s economy grew by 4.7 per cent in the June quarter over the previous year. That represents a slowdown from the 5.3 per cent growth reported for the first quarter and also lower than the 5.1 per cent that forecasters were expecting.

Wayne Calder

Director Economics

0424 852 384

[email protected]