Australian Economy

The International Monetary Fund (IMF) World Economic Outlook projects the Australian economy to grow by 1.5 per cent in 2024 and 2.0 per cent in 2025. This is a little slower that the Mid-Year Economic and Fiscal Outlook published by Treasury in December which forecast growth of 1.75 per cent in 2023-24 and 2.25 per cent in 2024-25. The IMF expects inflation to moderate from 5.6 per cent in 2023 to 3.5 per cent in 2024 and 3.0 per cent in 2025. The IMF also notes that Australian households are among the most heavily indebted in the world with household debt exceeding 100 per cent of GDP. This increases the sensitivity of Australian households to increases in interest rates given the predominance of variable rate home loans. Households in countries that have predominantly fixed-rate home loans such as the US are less sensitive to changes in interest rates and consumption has held up more strongly in these countries.

The ABS Labour Force Survey for March has recorded an uptick in the unemployment rate to 3.8 per cent (sa) from 3.7 per cent in February. Unemployment increased by 20,600 to 569,900. The total number of employed people is 14,259,800. The labour market remains relatively tight with the labour force participation rate remaining at near record highs.

The Westpac Melbourne Institute consumer sentiment index fell to 82.4 in April, well below the neutral level of 100. Consumer sentiment has been depressed for around two years and outside the 1990s recession marks the most protracted period of consumer pessimism since the 1970s. Inflationary pressures and the attendant rise in interest rates along with a rising tax take through bracket creep are exacerbating the cost-of-living pressures being felt by households. Consumers appear to be disappointed that the path to lower interest rates could be slower than expected at the beginning of the year.

The NAB business survey showed both business confidence and conditions remaining largely unchanged. Confidence rose 1 point to +1 and conditions fell 1 point to +9. Despite falling in the month, conditions remain above the series average and not far below their 10-year average. Conditions have held up through this cycle as the level of demand remained elevated and strong population growth added to aggregated growth. However, the general trend lower in conditions has been in place since they peaked in mid-2022.

International Economy

The IMF World Economic Outlook noted the resilience of the global economy following the disruptions caused by the pandemic and the Russian invasion of Ukraine. The IMF is projecting global growth of 3.2 per cent in 2024 and 2025 up from the low of 2.3 per cent in 2022. Global headline inflation is expected to fall to 5.9 per cent in 2024 and 4.5 per cent in 2025. However, the IMF cautions that while inflation is trending lower it remains persistent and that there are signs that the downward movement is slowing or in some cases reversing. Falling energy prices has helped push inflation lower, however, the IMF sees risks of new price spikes with an escalation of conflict in the middle east.

The US economy continues to confound policy makers and market commentators.

The labour market continues to show remarkable strength with 303,000 jobs added in March with the unemployment rate at 3.8 per cent. Unemployment remains at long-term historic lows with the unemployment rate being below 4 per cent for over 12 months. In another sign of the strength of the US economy, retail sales for March rose by 0.7 per cent, higher than the expected 0.3 per cent. Stronger post-pandemic immigration flows coupled with strong Government spending with the US budget deficit running at 6.0 per cent are key drivers of US economic activity. It is unlikely that there will be any steps towards fiscal consolidation during an election year.

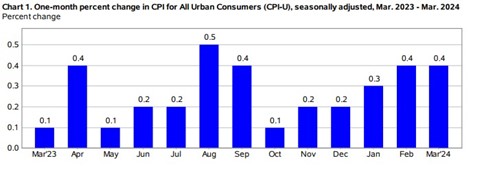

In the face of stronger economic activity, the consumer price index rose 3.5 per cent in the year to March, higher than expectations and marking an acceleration for inflation. The CPI rose 0.4 per cent for the month. The Dow Jones survey prior to the CPI release had expected the CPI to rise by 0.3 per cent in the month and by 3.4 per cent over the year. Core inflation rose by 0.4 per cent in March and was unchanged at 3.8 per cent over the year.

The strength of the US economy and the stronger than expected CPI has prompted a turnaround in the expectations of the speed and scale of official interest rates in the US. The Fed Reserve Governor has stated that “If higher inflation does persist, we can maintain the current level of (interest rates) for as long as needed”. Expectations are that downward movements in official interest rates in the US may be delayed to the end of 2024 and possibly 2025.

The European Central Bank (ECB) held its key interest rate at 4.0 per cent for the fifth month at its meeting on 11 April. In its statement the ECB noted “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” This is a rather heavily coded passage but reflects the ongoing messages of central banks that once the path to a sustained return to the target range is achieved, interest rates will fall. It may be that the ECB will look to cut rates earlier than the Fed Reserve.

China’s National Bureau of Statistics has reported that GDP grew by 5.3 per cent in the first quarter of 2024. This is above market expectations of an increase of 4.8 per cent and higher than the 5.2 per cent recorded in the December quarter. Industrial output was the main driver of growth in the quarter growing by 4.5 per cent while retail sales were softer at 3.1 per cent. The property sector continues to be the main drag on economic activity in China with the potential for rising trade tensions, particularly with the US, to impact on the Chinese economy going forward.

If you would like more information or have any questions please feel free to reach out to me.

Wayne Calder

Director Economics

0424 852 384

[email protected]